Peloton 1Q22 earnings breakdown

Summarising the most important points from Peloton's Q1 2022 earnings.

Quick highlights

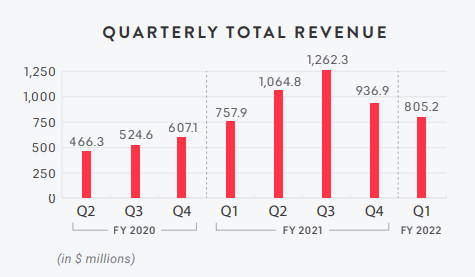

Total 1Q Revenue was $805.2 million +6% Y/Y but down 14% sequentially

Connected Fitness Revenue (Hardware sales): $501.0 million, down 17% YoY

Subscription revenue: $304.1 million, representing 94% year-over-year growth

Connected fitness activity: 120.5 million workouts +55% Y/Y

Average Net Monthly Connected Fitness Churn of 0.82% remains low.

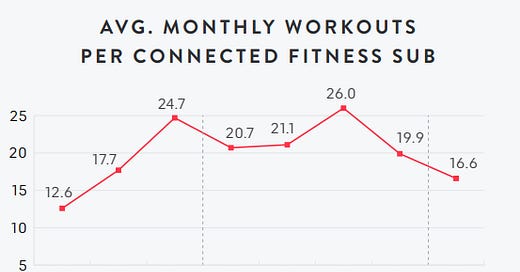

Engagement

Engagement continues to decline, despite Peloton’s best efforts. Many members have returned to the office and are working out less. Peloton again commented that upcoming 2Q and 3Q are colder months that increase engagement.

Guidance

Peloton mentioned that it’s struggling to provide accurate future guidance. The on-going impact of the pandemic means there is little certainty of what the new-normal looks like.

Peloton has revised guidance downwards, meaning revenues will be lower than anticipated. Peloton revised 2Q guidance with a range of $1.1 billion to $1.2 billion total revenue. Peloton is no longer providing churn guidance.

Bike price reduction

Some customers are trading down - the gap to the higher priced Bike is too great. Peloton says it’s happy to increase install base as the cost of short-term revenue. Improving long-term revenue due to increased subscription revenues. See Peloton pricing strategy).

Profitability

Peloton will continue to invest profits back into the business to drive growth.

Net loss for Q1 was $(376.0) million versus net income of $69.3 million in the same period last year.

Sales and marketing expense was $284.3 million, and grew 148% year-over-year, representing 35.3% of total revenue versus the prior year period of 15.1%. This is an incredibly high figure compared to the 12-20% suggested for new companies. Below provides a good comparison of where Peloton sits versus the technology giants.

Research and development expense was $97.7 million and grew 167% year-over-year, representing 12.1% of total revenue, versus 4.8% in the year-ago period. Growth was driven primarily by increased personnel-related expenses and research costs associated with development of new software features and products.

Analyst questions

One of the most insightful elements of any earnings call is the question and answer session. I’ve summarised the analyst questions and Peloton’s answers into themes.

Question: How much of reduced guidance forecast is due to Bike or Tread.

Answer: Bike portfolio is our largest and biggest seller. We’re guiding lower revenue to do increased sales of the lower priced Bike model. Previously we saw a 50/50 product mix between Bike and Tread and now it’s 75/25.

Question: You burned a lot of cash, how much cash are you comfortable operating the business going forward?

Answer: We don’t need any additional capital. We’re trying to reduce costs where possible.

Question: What is the consumer feedback on Tread?

Answer: 89 NPS score which is off the chart. Press reviews are positive (mentioned Engadget). Tread is a portal to full body workouts e.g. CrossFit where there is a large consumer demand. We need to educate customers that Tread is a portal to a total body workout experience. Marketing investment is required to increase awareness of the total body workout.

Question: What’s driving customer acquisition cost?

Answer: We’ve spent a lot on marketing the Tread. We need to build that up and it will take time to get customer acquisition cost (CAC) efficiency. We expect to get back to neutral CAC this fiscal year.

Question: What have you put into guidance to make it accurate?

Answer: We’ve learned a lot after the price drop and its impact on demand. We now have more understanding of seasonality from previous years. We’re confident guidance is accurate.

Question: Engagement remains key to the Peloton story. Can you provide more details?

Answer: People aren’t locked down so we expected a reduction in engagement. We’re building new content verticals and instructors. We’ve seen a seasonal impact that we’ve always seen. We expect engagement to be higher in winter months due to customer behaviour. We are seeing better engagement compared to gyms or competitors.

Question: How’s the integration of Precor companies going? What’s the subscription model for Precor products going forward?

Answer: Precor’s channels are softer than expected e.g. gyms and hotels. It’s not daunting in the short-term as we expect the channels to re-emerge. Peloton bikes hotels is a great sales tool. We capture leads using hotel locations and we see strong upside when these channels return to normal.

Question: What are you doing to increase demand?

Answer: We believe that Tread is a huge opportunity to drive significant growth as we increase awareness of the product. Our main opportunity is word of mouth from existing members and Tread is a strong growth engine. Bike remains a huge opportunity and the price drop is important to driving growth. We’re opening new channels e.g. corporate wellness. New markets are important e.g. Australia.

Question: What are the long-term margin opportunities?

Answer: Covid provided several quarters of high-growth. We’re now going to have a more seasonal business again. We need to right-size our business model so we can exploit the fixed cost efficiencies.

Question: Who is the target consumer given the new price point for Bike?

Answer: We are continuing to penetrate younger audiences (Under 35 year olds earning less than $50,000 total household income per year.) with lower household incomes. This will improve our total addressible market.

Question: What do you expect the percentage of sales and marketing of revenues to be?

Answer: We expect sales and marketing to reduce in 2Q21 to low to mid-20s.