How will Peloton get to 100 million members?

How should we assess the size of Peloton's market and where will the growth come from?

To answer the question, I’ve researched these areas:

Peloton’s view of its total addressable market

Market size for gym memberships

Are gyms ready for disruption?

Fitness applications

Apparel

Partnerships

Growth by acquisition

Expanding into new countries

How does Peloton view the world?

At Peloton’s investor and analyst session it positioned itself as disrupting the fitness industry in the comparison below:

Peloton pointed out it’s competing with health clubs and boutique fitness operators. However, in order to assess its total addressable market (TAM), Peloton uses the number of households, not subscriptions. This has created a bit of a disconnect for me, so I wanted to investigate further. How should we view Peloton’s route to 100 million members? Let’s first explore Peloton’s household view.

Peloton’s total addressable market

Peloton believes that any household that has broadband internet and an income over $50k is addressable. It has 1.7 million members with hardware and therefore 2.3% share. A large total addressable market (TAM) demonstrates to its investors the huge market opportunity. Peloton can continue to grow its product portfolio, whilst lowering prices and expanding its appeal to its potential customers, whilst addressing the short-term headwinds of supply constraints.

Peloton’s pricing model is based on the entire household being able to access the equipment at no extra cost. This allows Peloton to compete with fitness clubs on price and compare itself directly to them, even offering a handy price comparison tool on its website.

If Peloton is comparing itself so directly to gym memberships then let’s assess the size of that market.

So how big is the market for gym memberships?

As a comparison to the industry Peloton is disrupting, I’ve pulled data on the market size of gym memberships. There are nearly 100 million gym memberships in the countries Peloton operates. These gyms generate $68.3 billion dollars annually in revenue versus Peloton’s estimated $4 billion for this financial year. Peloton has a revenue share of 5.9% which is considerable. I didn’t think it was fair to include Australia because Peloton has only just entered this market.

My estimates assume the average annual subscription per member is $696.

Are gyms ready for disruption?

This study [paywall] found that 63% of gym memberships go completely unused. Gyms factor this into their business model. If you’ve ever stopped going to a gym for an extended period it’s actually in the gyms interest not to contact you. These are known as the ‘sleeping base’. As a gym providing a service, you daren’t wake them up in case they leave you.

Only 34% of US gym members believe that their gym is worth what they pay.

During the pandemic gyms scrambled to maintain memberships by freezing payments and offering online alternatives to fill the gap. Peloton benefitted significantly as my research of Peloton members showed 53% are unlikely to return to the gym after the pandemic ends. Peloton’s disruption is definitely real, but it’s not a zero sum game.

22% of Peloton members are likely to return to the gym post-pandemic. Some classes, such as yoga and weight lifting are better suited to a gym setting.

There’s certainly a big opportunity to disrupt gyms further. The ultimate trojan horse would be to utilise its Precor acquisition in order to embed Peloton within gyms and hotels. Many gyms will be looking to solutions like Peloton that offer on-demand, high quality content allowing them to charge a premium to its members whilst reducing the need for its own instructors and costs.

Fitness applications

As Peloton continues to establish itself and disrupt the fitness space it’s worth assessing the opportunity to grow rapidly with its fitness applications. Peloton’s application provides a simple and easy way to gain subscribers. Peloton admits its application doesn’t make money, instead it uses it to encourage purchases of its hardware. Because of this, Peloton is focusing its total addressable market on households. However, the market for applications is only limited by the number of smartphones available for the application to be installed on. In order to get strong economies of scale Peloton should leverage its content further, with a dual-strategy that boosts awareness of its brand whilst hardware sales.

In order to truly disrupt the fitness industry, Peloton should invest a proportionate amount in marketing its app. When Amazon understood its physical book sales would eventually be disrupted by eBooks, it invested heavily to disruptive itself with the Kindle. Apple’s Fitness+ could be a significant disruptor; Peloton should double down on its application and disrupt itself.

In a software world Peloton doesn’t have to worry about shipping delays and supply constraints.

It can forget about hardware issues that seem to plague many of its customers and the reverse logistics and customer services required to fix them. It just has to maintain the quality and frequency of its content. One thing Peloton does extremely well with popular instructors (mentioned here).

A good proportion of Peloton’s 100 million member goal is likely to come from its application. Apple has a significant advantage with Fitness+ with an estimated 72 million Apple Watch devices to target. Peloton could become the Netflix of workouts with the appropriate focus.

Apparel: Peloton x Adidas

Peloton’s line of apparel allows it to leverage its strong brand but also the extensive social media network of its instructors. In my assessment of Apple Fitness+ I tracked the number of followers Peloton instructors have.

With a median number of followers of 129,500 Peloton’s instructors are heavyweights in the social media stakes.

Robin Arzon, Peloton’s most followed instructor has 729,000 followers alone.

The partnership with Adidas allows Peloton to widen its distribution way beyond its direct to consumer model. Equally the Adidas brand widens the consideration of the apparel it produces. Prior to the partnership, Peloton reported annual earnings from apparel of $20 million. Adidas will likely double or even triple that figure due to its increased distribution and brand alone, particularly as retail locations start to reopen across the world. It puts Peloton’s apparel up against Nike, Puma and Reebok. Adidas gains a segment of the market in a similar way to Reebok benefitted from its CrossFit partnership.

Peloton will likely be looking at Gymshark that built a global apparel brand by leveraging social media influencers. In 2019 Gymshark’s turnover was $240 million and recently its brand was valued at $1.4 billion.

In the apparel space, Peloton has barely scratched the surface.

Partnerships

In October 2020, Peloton announced a partnership with German hotel group Kempinski where hotel guests could request a Peloton be brought to their room. Partnerships like this whilst initially small could bring massive scale in the future. The hospitality sector has been the worst affected by the pandemic, which will stifle initial demand. Hotels are struggling to stay afloat as guest numbers have dwindled. Precor has an extensive relationship with hotels and partnerships like this could boost its reach further. As hotels find their feet after the pandemic, innovative differentiators like offering guests Peloton bikes might help them stand out from the crowd particularly with business travellers.

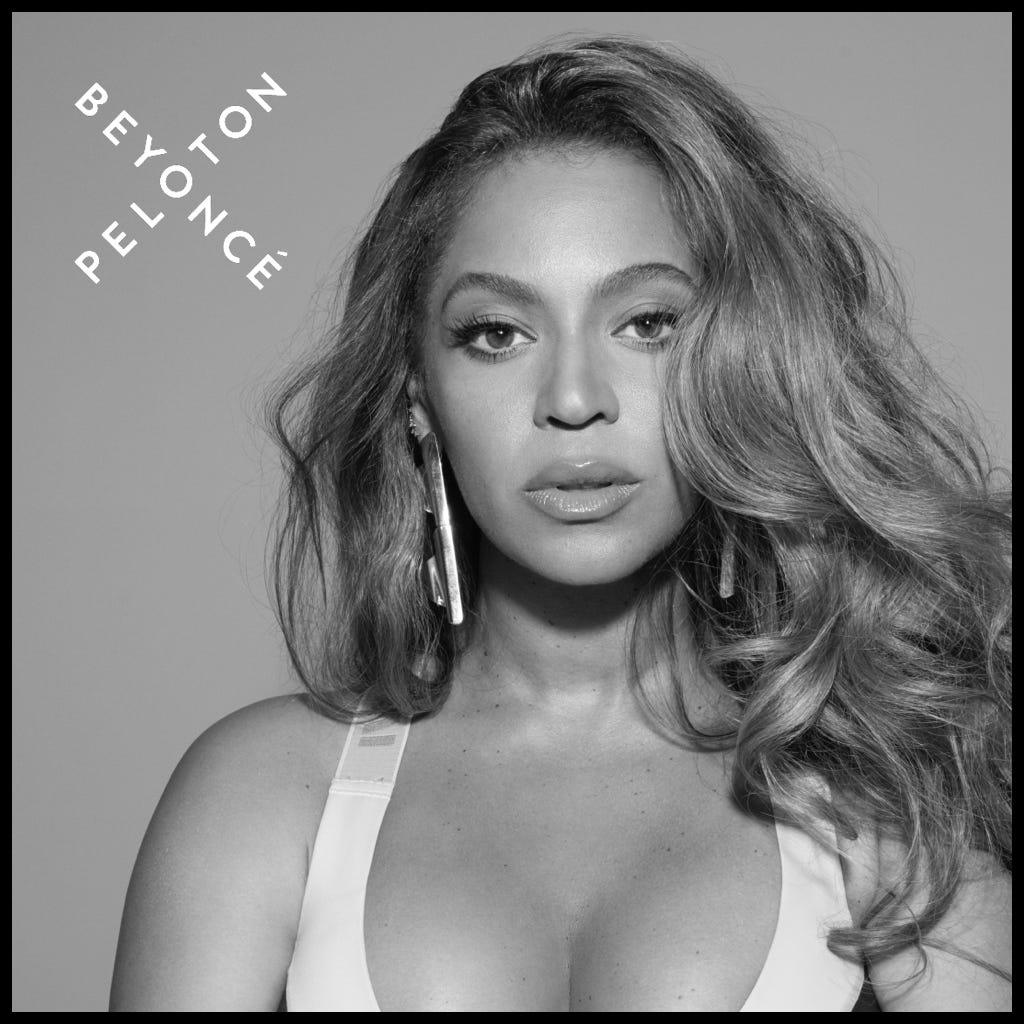

In October, Peloton announced a multi-year partnership with Beyonce to create themed classes that feature Beyonce’s music. Celebrity endorsements and partnerships build credibility and exposure to new markets.

As endorsements go, it doesn’t get much better than Beyonce. She has an insane market reach with 170 million followers on Instagram. Beyonce is the 9th most followed celebrity with a sponsored post costing as much as $1 million.

These endorsements will improve consideration as Peloton seeks to establish itself as a household name.

Growth by acquisition

Peloton has acquired companies for intellectual property and features that enhance the customer experience, not to increase its membership. Bob Treemore tracked the acquisitions in the chart below:

Peloton may look to acquire other applications and hardware manufacturers, growing membership by acquisition as a shortcut.

Expanding market reach

Peloton’s content is fantastic and its instructors are loved by its members. To enter other markets it can leverage its existing instructors, most of which speak English. Australia has already been announced adding an additional 6.6 million households with broadband internet (Peloton’s definition of addressable as mentioned above).

Philippines has 14 million people that speak English, it’s the countries official second language. It has approximately 8.7 million households with broadband making it another good opportunity for Peloton.

The Netherlands has approximately 15 million English speakers and 6.7 million households with broadband internet. It too would be a sensible market addition.

Peloton already has bilingual Spanish speaking instructors in Robin Arzon and Jess King but it would require significantly more diverse content to serve Mexico with its 122 million population and 22 million households that have broadband. Spanish content would allow entry to other Spanish speaking countries such as Spain and Argentina.

China represents the biggest opportunity with its 452 million households with broadband internet, but it would also require significant investment in instructors and Mandarin and Cantonese language support.

Summary

Peloton’s household reach will increase exponentially as it adds new countries

There are approximately 100 million gym members in the countries Peloton operates generating $68.3 billion dollars annually

Gyms are ready for disruption as the pandemic continues

Peloton should disrupt itself by doubling down on its fitness application

Expanding further into apparel with its partnership with Adidas presents a sizeable opportunity

Peloton could look to grow by acquisition

There are a number of English speaking countries Peloton could go to next, such as the Philippines and the Netherlands

If you enjoyed this newsletter, subscribe to receive future emails directly in your inbox, every week. I write analysis on Peloton and home fitness. If you’d like to buy me a coffee then please click the button below. Thank you.