Charting Peloton's progress

Reviewing the key performance indicators (KPIs) from Peloton's quarterly earnings statements.

Peloton continues to march forward with impressive growth, galvanised by the global pandemic. But what are the key metrics that show its heading in the appropriate direction?

Engagement

One of Peloton’s KPIs is the number of workouts per member, per month. It’s extremely impressive to see the various steps Peloton has taken to get its members more active. That means going beyond the traditional workouts like cycling and strength training to adding in yoga and even outdoor workouts. Engagement is one of Peloton’s key metric and one Peloton believes it needs to improve in order to keep members happy. It’s seriously impressive to see the growth in workouts per subscriber increase.

When you look at it quarterly you see just how impressive Peloton has become at keeping its members engaged. If you consider gyms actually make more money when members don’t attend you realise how disruptive this metric is to the fitness industry. It’s Peloton north star.

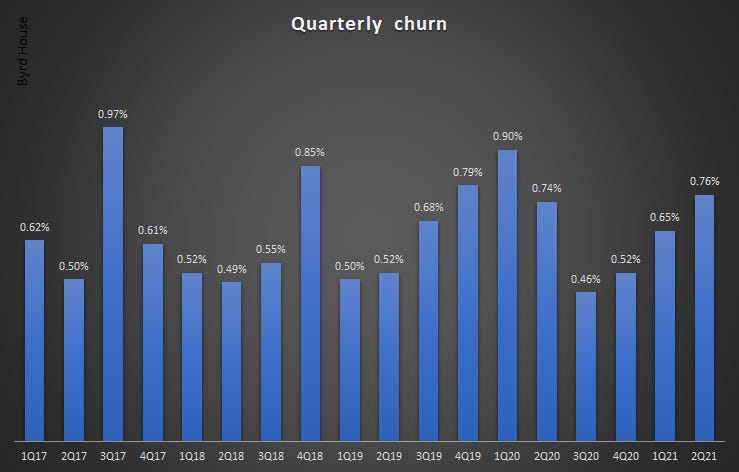

Churn

A key metric is customers cancelling their Peloton subscriptions. This is typically called churn and is a key measure of success. You’re always going to have a leaky bucket with customers inevitably leaving you. Some times there’s nothing Peloton can do to convince customers to stay but the vast majority are remaining loyal month after month. I believe loyalty is built on the engagement of its members. By focusing on fantastic and varied content, delivery by a wide range of exceptional instructors it’s a habit that remains. Equally, the community that’s built around Peloton means you’re more likely to feel committed.

Interestingly churn is pretty much flat and has never increased beyond 1%. It means Peloton is adding members at a considerable pace. Churn is at extremely manageable levels.

Revenue

Revenue will also be the key metric, depending on your view of whether Peloton should be profitable. Theory suggests that Amazon’s lack of profitability for many years allowed it sneak up on its retail competitors. It’s easy to dismiss a companies performance if they’re not making money.

Peloton’s quarterly growth is extremely impressive. Revenue exceeded $1 billion for the first time in 2Q21. As long as it keeps members loyal they continue to pay Peloton subscription fees every month. It reminds me of BlackBerry’s early days when it sold the phone and then received a monthly service payment. When you’ve got millions of members that soon starts to grow exponentially.

Members

Peloton has seen its membership numbers increase perhaps slower than it had hoped. Supply issues meant it couldn’t supply bikes and treadmills quickly enough. That is perhaps why we see a strong growth in digital members; those that don’t own hardware.

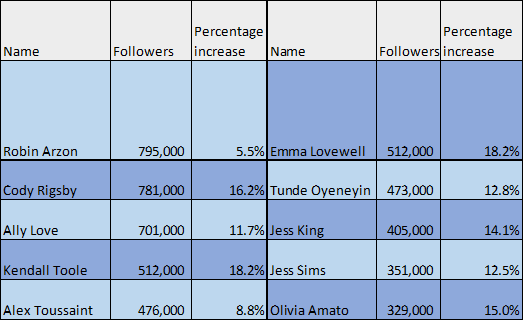

Instagram

Peloton’s instructors provide a powerful marketing tool with extensive reach on Instagram.

Peloton’s instructors are also growing followers at a significant rate:

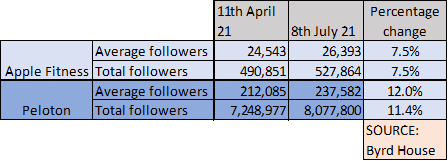

It is also grew followers faster than rival Apple Fitness+:

Summary

Peloton continues to tick all the boxes on the KPIs it reports:

Engagement is increasing and Peloton places a lot of emphasise on this key metric

Churn remains stable

Revenue growth is compounded by monthly membership payments

Membership numbers continue to grow but were hindered by slow delivery times

Peloton instructors are Instagram heavyweights providing a powerful marketing tool. They’re growing followers faster than rivals

I love your newsletter, and your analysis is really insightful. That said, I think you're getting suckered into Peloton's engagement metrics game.

As you know, they're presenting their rider engagement by number of workouts. The thing is that Peloton is artificially inflating the number of workouts by nearly eliminating the 45 and 60 minute rides that have traditionally been the mainstay of spinning classes and the Peloton platform for most of its existence.

Instead of continuing to program as many long classes, they've introduced "stacked" classes which sort of approximate a longer workout but which have the benefit of doubling or tripling the number of "workouts" that a rider takes for a given period of time. Which also, conveniently just happens to boost the metric that Peloton has framed for the market as the key data point for engagement.

The engagement question that analysts *ought* to be asking is how the aggregate minutes of workout per subscriber compares MtM and YoY.